As a leading Insurance Tech company, Majesco aims to reinvent the future of insurance. Every sector is undergoing digitization, and the insurance industry is no exception. With rising customer expectations and market competition, the need for technologically advanced tools is more than ever. Majesco keeps the increasing market and customer demands at the forefront and designs efficient solutions to make the insurance space easy to navigate.

As a leading Insurance Tech company, Majesco aims to reinvent the future of insurance. Every sector is undergoing digitization, and the insurance industry is no exception. With rising customer expectations and market competition, the need for technologically advanced tools is more than ever. Majesco keeps the increasing market and customer demands at the forefront and designs efficient solutions to make the insurance space easy to navigate.

Majesco’s innovative approach combines technology with industry experience, making it a reliable P&C and L&C support for insurers. With its SaaS platform consisting of core, digital, analytics, and distribution solutions, Majesco assists over 350 insurers, reinsurers, brokers, MGAs, and startups.

Change is inevitable, and Majesco understands that. Instead of avoiding change, Majesco embraces it and creates unique solutions compatible with the rapidly evolving industry. The company successfully merges simplicity with modernity to bridge the gap between traditional market practices and digitization.

The insurance sector is not a stranger to challenges. Various factors, such as increasing competition, technological evolution, outdated tools and infrastructure, rising operation costs, and low customer engagement, disrupt the pace of the industry. Majesco uses its knowledge to design practical and customizable solutions tailored to the requirements of individual enterprises, which combat these challenges.

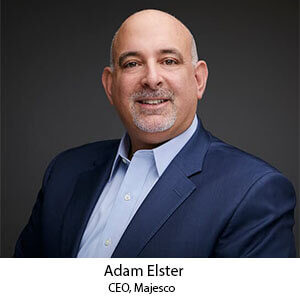

“To succeed in the future of insurance, which is coming faster than most realize, insurers must lay the groundwork of a new digital insurance business model. Future market leadership and success will be defined by focusing on the customer experience, business innovation, and technological leadership,” said Adam Elster, CEO of Majesco.

Majesco develops and delivers insurance platforms that serve as solution portfolios. With its insurance portals, Majesco displays its ability to curate innovative microservices that support on-demand products and business models. Majesco’s platforms comprise dynamic solutions and products that work together for better results, productivity, and customer engagement.

Digital1st Insurance, Majesco’s insurance platform, provides clients with a rich and accessible service ecosystem. It contains configurable portals for customers and channels that cover every aspect of insurance transactions. Its user-friendly and intuitive user interface allows easy access, enhanced customer experience, and seamless insurance processes. Majesco allows its clients to plug and play with next-generation partner ecosystems and third-party services for improved digital services.

Additionally, Digital1st Insurance updates existing tools and launches new products that transform the digital operating model using non-traditional distribution servers. It enables upgrading to advanced business models without compromising or affecting the current infrastructure. On-demand products, services, and channels deliver customized experiences and business growth with lower development costs and faster ROI.

Another Majesco platform, Digital1st Engagement, is a portfolio of app modifications and features that provide optimum and personalized customer journeys. It uses configurable apps to understand user preferences and patterns to deliver tailored customer experiences. The in-built analytics and critical touchpoints monitor customer engagement for better recommendations.

Unlike standard applications that lose their value after initial usage, Digital1st Engagement provides a reusable platform for critical transactions and operations across multiple business functions. This portal uses next-generation tools and third-party features to build an accessible and easy-to-navigate plug-and-play experience.

Launched in 1982, Majesco uses decades of expertise and knowledge to design productive and performance-boosting products. Cloudinsurer, a cloud-based insurance platform, offers a competitive edge with high speed, low costs, and scalability. This tool studies changing market trends to communicate with new channels and develop innovative products.

Cloudinsurer ensures that clients stay in the loop and up-to-date with constantly evolving advancements and market requirements by delivering advanced automation, monitoring, and assistance. Its rapid deployment (within weeks or months) and ability to relocate capital and resources to match business models enable users to reshape project objectives.

Majesco’s Property and Casualty solutions power the development of new tools, services, and networks that enhance the future of insurance. The P&C Core Suite product provides advanced personal and commercial compensation and specializes in compatible devices like on-demand telematics and parametric resources.

With a mission to accelerate business growth and development, this product provides thorough lifecycle processing momentum for all P&C tools, including the latest products. The P&C Core Suite attains increased visibility, speed, and agility by adopting flexible business insurance models with pre-configured contents, such as ISO guidelines. The pre-integrated Digital1st® Insurance platform delivers customized user experiences and improved interactions.

Another P&C solution, Loss Control 360, automates the entire project lifecycle. It creates an efficient environment using AI-powered tools that collect data, integrate business solutions, use third-party files, and inspect results. Additionally, this product employs configurable survey management tools to generate accurate third-party and contributory data for risk identification, analysis, and elimination.

Loss Control 360 analyses business models to recognize survey suggestions. Majesco’s product empowers businesses and improves field loss control through automated lifecycles, tailored surveys, and a customer-centric approach for quicker results and better customer interactions.

Majesco’s P&C digital solutions allow customers to walk side-by-side with digital migration, evolving demographics, and new industry patterns and expectations. Insurers require digital support to understand customer demands and get an edge over their competitors. In today’s day and age, customer satisfaction takes the wheel. Insurers must be equipped with the latest technological tools to cover the entire insurance spectrum—and Majesco feeds the digital needs.

With its digital solutions, Majesco reshapes insurance processes and experiences. It uses new digital features to acquire data from various internal and external sources to make quick, accurate, and beneficial business decisions.

Majesco Ecoexchange, Majesco’s futuristic partner ecosystem portal, uses creative solutions to enhance data and business development and extend core, distribution, and analytics reports. Along with Majesco’s Digital1st Insurance and Digital1st Engagement platforms, Ecoexchange optimizes the customer experience and meets channel needs through APIs and microservices.

Majesco delivers its support to clients across the globe. The New Jersey-based company offered assistance to the life insurance company Acorn Life, specializing in protection, savings, and investment products. The company practiced a manual, face-to-face sales process by planning meetings at their customers’ homes or place of work and followed the rest of the procedure by visiting the nearest branches to comply with anti-money laundering requirements. The long and time-consuming process resulted in a loss of resources, low customer engagement, and reduced sales.

To help Acorn Life, Majesco implemented a digitalized point-of-sale solution. The digitalized solution supported sales of financial services. Additionally, Majesco Life AdvicePlus quickly configured Acorn Life’s end-to-end customer experience. It used e-signatures to complete the purchase process and delivered a digital-centric user experience.

With Majesco’s support, Acorn Life had the best December sales in ten years and saw an increase in accurate data collection and reporting. Majesco Life AdvicePlus reduced overhead costs, provided zero percent downtime, and created a digital cloud-based portal to launch new products and services.