All organizations must have a governance, risk, and compliance management strategy. Abiding by governance policies, risk protocols, and regulatory compliance is essential to perform operations confidently and securely. Risk Warden is a comprehensive compliance management platform that allows risk owners to provide evidence to relevant risk and compliance authorities as and when required. As a leading GRC solution provider, Risk Warden helps risk owners of complex buildings to manage their post-risk assessment corrective actions and compliance management swiftly and effectively.

All organizations must have a governance, risk, and compliance management strategy. Abiding by governance policies, risk protocols, and regulatory compliance is essential to perform operations confidently and securely. Risk Warden is a comprehensive compliance management platform that allows risk owners to provide evidence to relevant risk and compliance authorities as and when required. As a leading GRC solution provider, Risk Warden helps risk owners of complex buildings to manage their post-risk assessment corrective actions and compliance management swiftly and effectively.

Risk owners face various challenges navigating the GRC landscape. Traditional tools, such as multiple Excel spreadsheets, standard document storage, and regular meetings to manage and track risk and compliance activities pose many problems. Problems include capturing information in the correct format, dispersed information and documents, trouble mapping regulations to estate assets, difficulty tracking goals, and long and manual processes that lead to a lack of control, severe inefficiencies and human error.

Furthermore, conventional tools make compliance audits time-consuming and challenging to identify up-to-date compliance status, risk type, and risk scores. Moreover, the lack of transparency and visibility of information across stakeholders makes specific estate data inaccessible.

With its cloud-based software platform, Risk Warden provides a digital framework to handle all property risk and compliance requirements. Risk Warden’s document collection module lets firms specify the required documentation, check if they have been captured against a specific property, upload missing documents quickly and easily, and share them through a secure portal with internal stakeholders, regulators, and authorities. Additionally, the company’s real-time, role-based reports and dashboards ensure users can instantly access relevant information and KPIs.

Risk Warden’s cloud-based module also allows users to create custom reports and dashboards to cover every eventuality and custom KPIs. Risk Warden solves all GRC-related challenges by designing a holistic and entirely digital plan to cover risk and compliance management that interconnects, automates, and streamlines activities and tracking that enables organizations to remain compliant and control potential risks.

Our professional team is constantly monitoring trends, regulations, and legislation and continually engaging with our customers to ensure that our solution remains relevant and that our customers can remain compliant, both now and into the future. We are constantly developing new modules, features, and enhancements to tackle new and existing challenges in our space– Brent Young, CTO of Risk Warden.

Risk Warden is highly customizable, and its ability to adapt to risk and compliance across any sector really sets it apart. Risk Warden’s risk and compliance management solutions include all the components required to reduce human error due to manual information collection and collation, prevent a lack of visibility of information and documents, and reduce inefficiency across resources. The GRC solution provider ensures its strategies allow comprehensive estate management, efficient task management, and integrated and professional grade risk assessments.

Risk Warden’s digital platform also enables adaptive risk management, structured and interconnected document management and seamless contractor collaboration. On the compliance management side, it offers flexible governance, inheritance, gap analysis and automates related tasks. The comprehensive business intelligence module allows you to track, study, and analyze every part of an organization’s risk and compliance from a single platform.

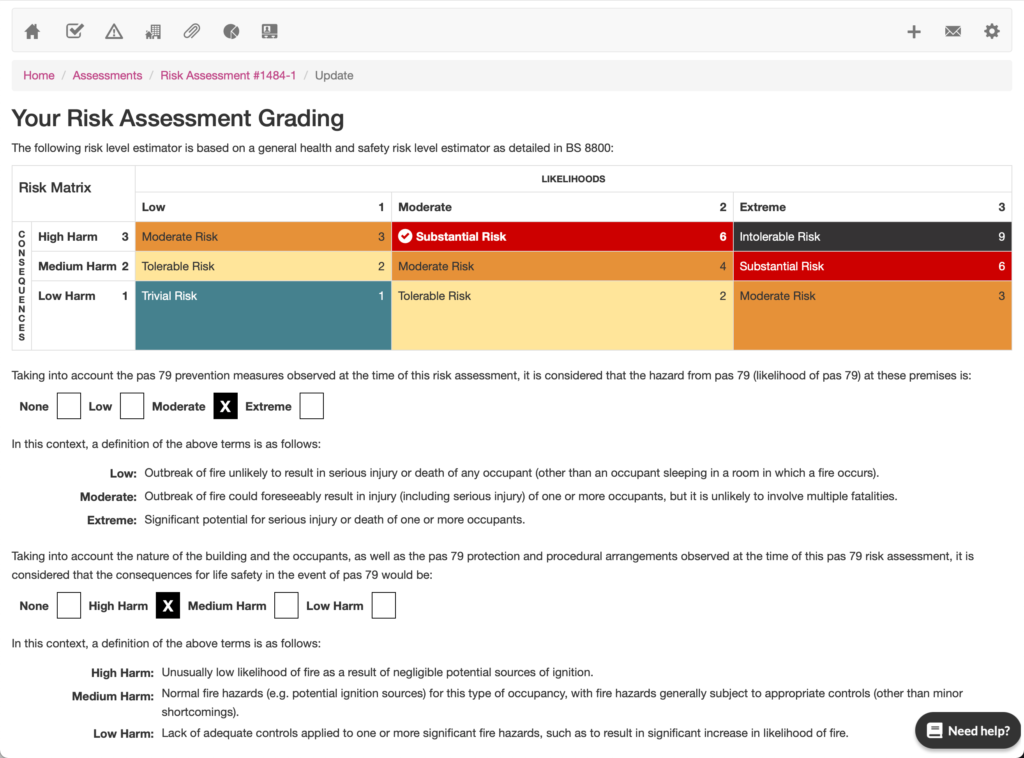

The platform comprises various key features that make it the best GRC tool. The platform’s world-class, comprehensive, and professional grade risk assessment module allows risk owners to plot multiple hazards directly to a floor plan, in list mode, or both. With its risk reduction technology, the digital tool gives risk owners real-time risk score visualization across their estate instead of a historical snapshot.

The digital platform’s visual compliance score and status features display the compliance status of every aspect of an estate. It gives customers overall compliance percentage scores for their entire estate and a percentage score for each part of the estate, such as property type, property, asset type, and asset. The gap analysis feature gives customers an in-depth report of what is compliant and non-compliant and the causes, with a way to quickly action missing information from a single screen. Finally, the single source of truth enables transparency by giving customers the necessary tools and information to remain compliant.

Risk Warden assists all risk owners requiring a digital transformation to control risk and compliance. Risk owners that use Excel spreadsheets, standard cloud-based document storage, or multiple systems to manage various risk and compliance aspects face a common challenge of dispersed risk assessments, documents, and information. This dispersed information makes it impossible to holistically view and manage risk and compliance across their estate.